When is a housing subsidy not a housing subsidy?

When it subsidizes homeownership.

When is a housing subsidy economic stimulus and not charity?

When the money supports bankers, real estate agents and developers.

In 2017, the federal government subsidized homeownership to the tune of $140.7 billion dollars; it is estimated 75 percent of this allocation went to households earning over $100,000.00. In 2017, the federal government subsidized rental assistance housing to the tune of $46.0 billion dollars, all of which went to households poor enough to “qualify” for this assistance. Guess which of these two housing assistance programs of the federal government are being proposed for massive cuts in 2018. We’ll give you one hint: bankers and real estate agents are not freaking out!

By some estimates, Trump’s proposed Department of Housing and Urban Development (HUD) budget will lose over $7.5 billion dollars in funding when all 2017 funding allocations are tabulated at the end of the year; on other calculations, it could be $6.4 billion. Either way, nobody is disputing the reality that upwards of 250,000 households will almost certainly lose their housing support, that the 10,000 units of public housing lost each year due to lack of maintenance will dramatically increase and that Community Development Block Grants, HOME, and other programs targeted to serving poor communities will be eliminated.

Nor is there any disputing that $133 million dollars will be cut from Homeless Assistance programs or that rents will increase from 30 percent to 35 percent of a person’s income, that $60 million will be cut in Rural Housing rental assistance as well as the elimination of farmworker housing loans and grants.

All this pain and suffering so that HUD’s budget can be reduced to $40.7 billion while homeowner housing subsidies are expected to rise to $162.5 billion.

What is the difference between a homeowner subsidy and a renter subsidy, you may wonder. Not much in terms of a fiscal impact on the federal budget, but very different in terms of administration. Homeowner subsidies are administered by the IRS and are allocated to homeowners via tax breaks; renter subsidies are administered by HUD and are paid out to property owners or public housing authorities. Two different programs with very, very different sets of protocols, rules, and qualifications, but both are equally housing assistance programs and both equally cost the federal government money. If you owe me $50 and I tell you to keep it (IRS), I just gave you $50. On the other hand, if you ask me for $50 and I give you $50 (HUD/USDA), it costs me $50. That’s economics 101, simple.

So why is it that one type of housing assistance has no cap on costs, has no eligibility requirements except being in debt with a mortgage, and isn’t considered charity?

Instead, it is seen as economic stimulus and good and healthy for America’s economy. On the other hand, the much, much smaller renter housing assistance program has a byzantine screening process, has thousands and thousands of households on its waiting list, is hotly debated each year, and consistently cut as part of the federal budget process. Because it is categorized as charity to the poor rather than economic stimulus, and certainly is not considered good or healthy for America’s economy.

Since housing is a good and healthy thing for homeowners, it only makes sense that it would be a good and healthy thing for renters. Since money owed and not collected is the same as money expended, then surely both forms of housing support are of equal value and both have a financial impact on our federal budget.

So what could possibly be the justification for there to be such a growing disparity between the two programs?

The only logical conclusion one can reach when these two programs are seen as being of equal benefit and financial burden is that who is benefiting from each of these programs—poor people versus homeowners—dictates their worth.

In the cold reality of neo-liberal American economic policies, what benefits bankers, real estate and developers far outweighs what benefits poor people and communities.

If “WE” can afford $140 billion dollars to support housing for Homeowners, the argument that “WE” can not afford $140 billion dollars to support renters seems shallow, and frankly, it sounds like bullshit.

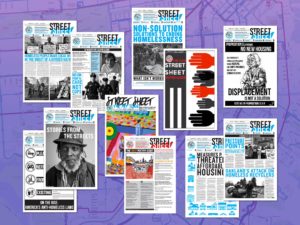

Until we recognize housing as a human right and enact policies and budget allocations that reflect that right, along with quality education, economic security, and health care, we will not end homelessness. So the Western Regional Advocacy Project is calling on the federal government to: 1) Restore federal affordable housing funding to comparable 1978 levels; 2) Turn empty buildings into housing; 3) Improve living conditions in existing affordable housing; 4) Put moratorium on demolitions without replacement and right of return; 5) Stop criminalizing poverty and homelessness.